Hey there! 🌟 Today, we’re diving into something pretty cool and important in the world of trading: demand and supply zones. These zones help traders figure out where prices might go up or down based on what’s happening in the market. So, let’s break down the three main parts of a zone in a way that’s easy to understand. Ready? Let’s go!

What Are Demand and Supply Zones?

Before we get into the nitty-gritty, let’s quickly talk about what a demand and supply zone is. Think of these zones like special areas on a price chart where big moves happen. They help traders spot where prices are likely to change direction because of buying or selling pressures.

The 3 Components of Demand and Supply Zones

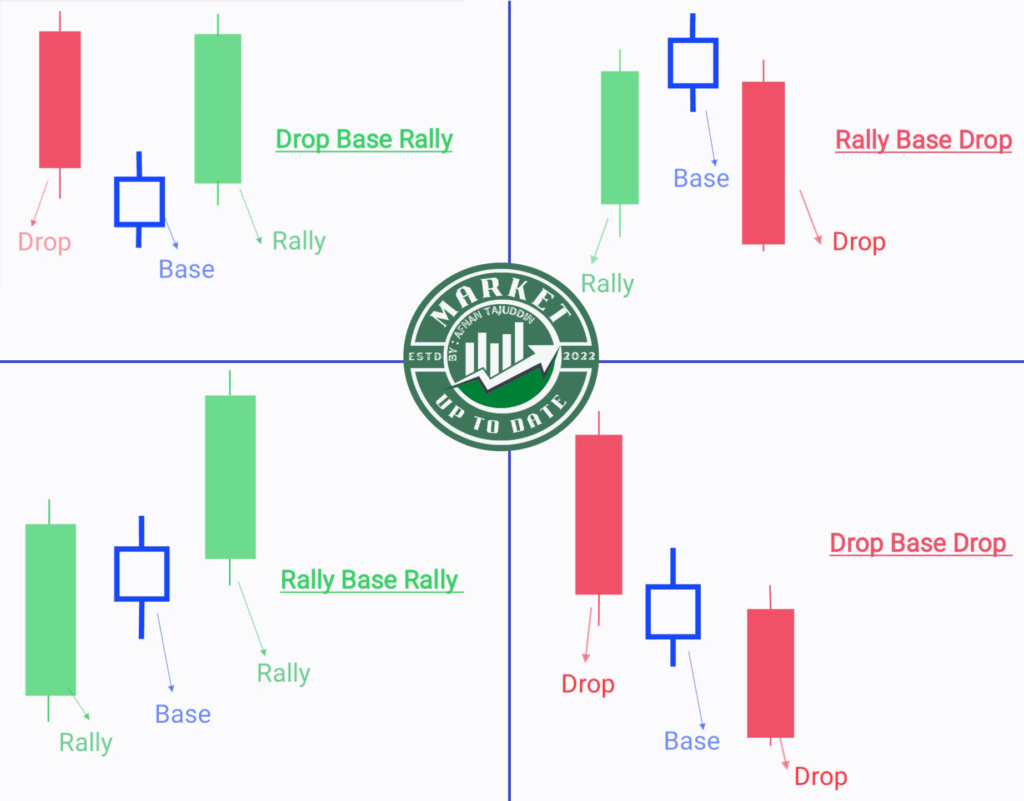

A zone has three main parts or components that traders look for. These are:

- Leg-In

- Base

- Leg-Out

Let’s break down each one!

Leg-In Candle

The Leg-In Candle is the first piece of the puzzle. This candle shows us the price movement before we hit the “base” part of the zone. Here’s what you need to know:

- Not Always Big: The Leg-In Candle doesn’t have to be a huge move. It can be a moderate change where the price either goes up or down.

- Colors Matter: If the candle is green, it means the price is going up. If it’s red, the price is going down. But remember, it’s not about how big the candle is—it’s about showing a move in one direction.

Base Candle

Next up is the Base Candle. This is where things start to get a bit more stable:

- Narrow-Range: The Base Candle should be smaller compared to the Leg-In Candle. It’s like the calm before the storm, where the price is not moving a lot.

- Between the Legs: This base is found between the Leg-In and Leg-Out Candles. It helps show that there’s a balance between buying and selling.

- Limit of 6: To keep things valid, the Base Candle should be no more than 6 candles long. If there are more than 6, the zone might not be considered good.

Leg-Out Candle

Finally, we have the Leg-Out Candle. This is where the action really picks up:

- Explosive Move: The Leg-Out Candle is a big move that happens after the Base Candle. It shows a strong change in price.

- Signals Big Players: When you see this candle, it often means that big institutions or traders are making moves. This helps us see how powerful the zone is.

How Zones Are Formed

Now that we know what each component is, let’s see how they come together to form a zone:

- Leg-In: This part shows a noticeable price move, which hints that there might be an imbalance between buyers and sellers.

- Base: Here, buying and selling are balanced, meaning the market is in equilibrium.

- Leg-Out: This is where things get unbalanced again, often because big players are making their moves.

If you see all three parts together, then you’ve got a zone! If not, it might not be a zone.

Why It Matters

Understanding these components helps traders make better decisions. By knowing where these zones are, traders can predict where the price might go and make more informed choices.

No Need to Stress About Finding Zones—We’ve Got You Covered!

But don’t worry, you don’t have to stress out about finding demand and supply zones on your chart all by yourself. 🎉 Our handy TradingView indicator does all the hard work for you! Check it out here: Smart Money Demand & Supply Zones Indicator.

This indicator automatically marks demand and supply zones on your chart, so you don’t have to manually spot them. And guess what? The pricing is very affordable! You can find all the details and pricing here: Market Up2Date Pricing.

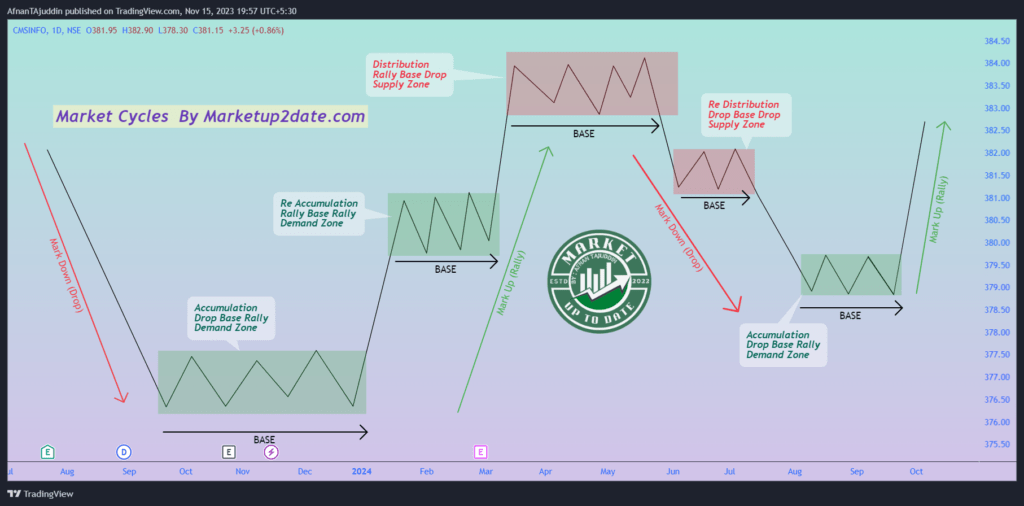

Take a look at the image above. It’s a snapshot from TradingView showing how our indicator automatically plots the demand and supply zones on your chart. So, why wait? Grab our indicator and let it do the work for you! 🚀📉

Summary

So, to wrap it up:

- Leg-In Candle: Shows a move before the base.

- Base Candle: Indicates a balance between buying and selling.

- Leg-Out Candle: Marks a big move that shows institutional activity.

Knowing these components helps traders spot important zones where prices might change direction. It’s like having a special map that guides you through the trading world!

I hope this simple guide helps you understand the basics of demand and supply zones. Happy trading! 🚀📈